In today’s marketplace there is a wide variety of products available to those who want the security and profit potential of gold. If you are contemplating an investment in gold, you should give the same careful thought to your options as you would to any other important financial decision.

First of all, to truly benefit from the unsurpassed security of owning gold, you should understand that the only way to accomplish this objective is to own physical gold. Other gold investments, such as exchange-traded funds (ETFs), gold mining shares and gold accounts provide investors with exposure to movements in the price of gold, but do not provide the security that only physical gold can provide.

In order to buy gold you need to understand that there are two types to choose from.

Bullion Coins and Bars

Bullion Coins and Bars

Individuals can select from a broad array of gold and silver bullion coins issued by governments around the globe. Examples are the Gold American Buffalo, the Gold American Eagle, the Canadian Gold Maple Leaf, the Austrian Philharmonic, the South African Krugerrand and several others.

The current market value of a bullion coin is determined by the value of its gold content, plus a premium that varies between coins, dealers and market conditions. These bullion coins are most commonly available in 1/10, 1/4, 1/2 and 1 ounce sizes. One should be aware that the premium tends to be higher for smaller sizes.

Gold and silver bars are also available in a wide assortment of weights and sizes, ranging from as small as one gram to 400 troy ounces (the size of the internationally traded London Good Delivery bar). For individuals looking to take physical delivery of their precious metals, the 400-ounce bars lack the convenience, portability and practicality of coins and smaller bars. Bars are manufactured by literally dozens of internationally recognized refiners around the world.

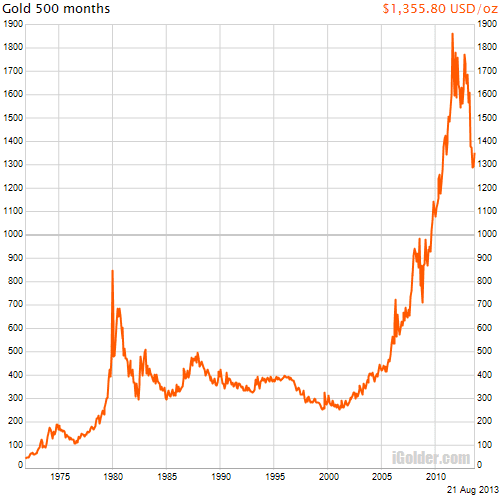

The spot/indicator price of gold has increased exponentially from the $20 per ounce price at which American Double Eagle coins were originally struck! For a free gold information kit please click here.

From $20 an ounce to almost $1900 an ounce gold has acted as a store of value; don’t miss this opportunity to add gold to your portfolio!

Bullion

When considering gold for the first-time, the first thing that comes to most peoples’ minds is gold bullion. This is probably because bullion represents the majority of available gold in the marketplace, and bullion is heavily marketed by companies and even government mints. Bullion can be bought and sold with ease in two forms:

Gold Bullion Coins

Gold bullion coins are legal tender of the country of issuance, and their gold content is guaranteed. Each bullion coin bears a face value that is largely symbolic; its true value depends on its gold content and the day-to-day changing price for gold. While bullion coins are normally purchased for their intrinsic value, they are also appreciated for their artistic appeal and beauty.

Bullion coins are available in a variety of sizes, ranging from 1/20 oz. to 1 Kilo, but the most popular and widely traded size is 1 ounce. A bullion coin provides outright, direct ownership of pure gold, and because it is legal tender, its authenticity is guaranteed by the country of origin. Gold bullion coins can be easily bought and sold virtually anywhere in the world. Among the most popular bullion coins are the Gold American Eagle, the Gold American Buffalo, the South African Krugerrand, the Gold Canadian Maple Leaf, the Australian Kangaroo Nugget, and the Austrian Vienna Philharmonic.

Gold Bullion Bars and Ingots

Gold bullion can also be acquired in bars or ingots. These bars can be readily obtained in a variety of weights and sizes, ranging from as small as one gram to 400 ounces, though the 1 ounce to 10 ounce sizes are the most popular for individual buyers. There are over 90 recognized bar manufacturers and brands produced in at least two-dozen countries around the world. The manufacturers combined put out hundreds of types of gold bars.

Gold bullion can also be acquired in bars or ingots. These bars can be readily obtained in a variety of weights and sizes, ranging from as small as one gram to 400 ounces, though the 1 ounce to 10 ounce sizes are the most popular for individual buyers. There are over 90 recognized bar manufacturers and brands produced in at least two-dozen countries around the world. The manufacturers combined put out hundreds of types of gold bars.

Gold Bullion Pricing

Prices for bullion coins and bars are based on the underlying price of gold bullion, plus a small premium, which can fluctuate depending on current market conditions. The underlying price is usually referred to as the “spot price.” The term “spot” is used in commodities trading to denote something which can be delivered for immediate settlement. Typically these contracts are for 100 ounces or more.

Executive Order 6102

When considering owning gold bullion, you should be aware that the U.S. has had bans against or financial disincentives for the private ownership of gold in the past. This is one reason why the U.S. government has reporting requirements for bullion transactions.

America has had four gold confiscations over the course of our history, including the one which was ordered in 1933 at the height of the Great Depression. In that year, under the authority of the Emergency Banking Act, President Franklin Delano Roosevelt issued Executive Order No. 6102, which ordered all privately owned gold bullion and bullion certificates in the United States be confiscated by the government. In return for their gold, Americans would receive paper money.

From 1933 until 1974, it was illegal for U.S. citizens to own gold. However, what few people realize is that, when the freedom to own gold was restored in 1974, a provision of the Federal Reserve Act was retained which permitted the Secretary of the Treasury to require individuals to surrender their gold bullion. This action would most likely be started by an Executive Order from the president. To this day, the private ownership of gold is a privilege allowed by the federal government, and not a right granted by our constitution.

In addition to gold; silver, platinum and palladium can all be purchased in bullion form. For pricing, availability and more information please contact an ITM Trading representative at 888-OWN-GOLD (888-696-4653).