LYNETTE’S GAMESTOP & ROBINHOOD BREAKDOWN: The Truth Behind GameStop & Robinhood Fiasco

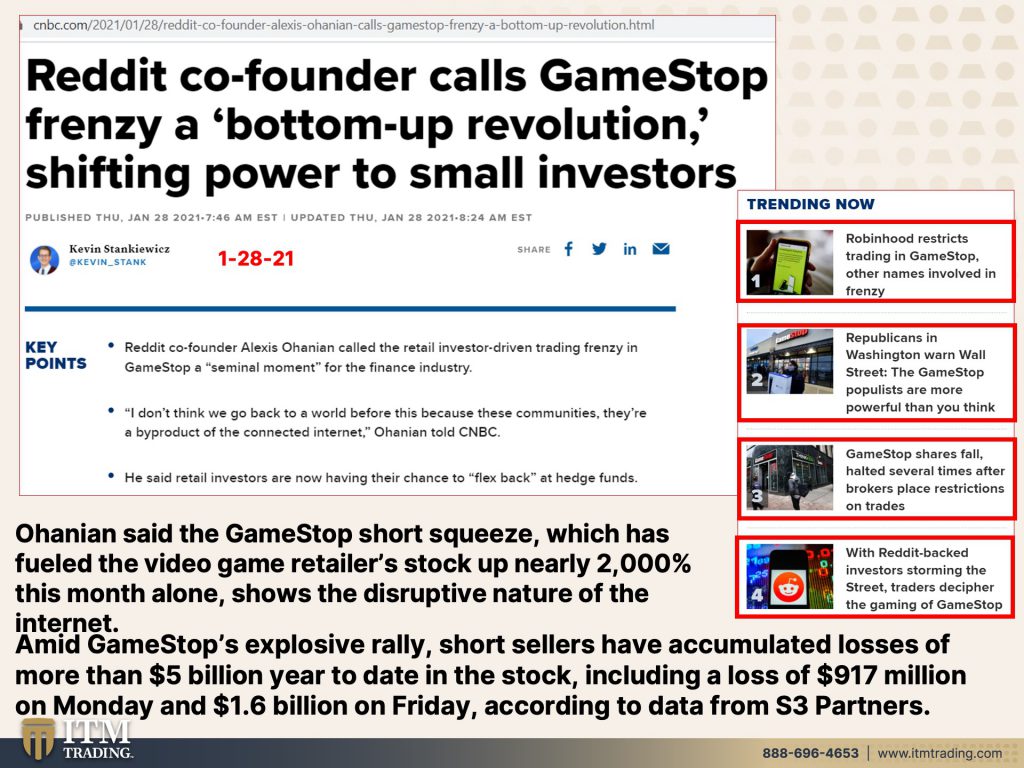

These days Wall Street talking heads are all talking about Reddit’s GameStop revolution and the shifting power from hedge funds to small investors. They site the individual stimulus checks and extra unemployment benefits, people being home with nothing to do, Robinhood’s gamification and free trading, along with the power of Reddit’s chat room as the culprits for the nearly 2,000% rise in GameStop this month.

Because of that rise, hedge funds, who have sold GameStop short (sold shares they do not own but must go into the market to buy) have lost more than $5 billion year to date, though at this writing, no hedge fund appears to have collapsed because of it (More about that in a second). At this writing, there have been at least 5 trading halts in the stock and Robinhood has halted new buying of this (and other) stock.

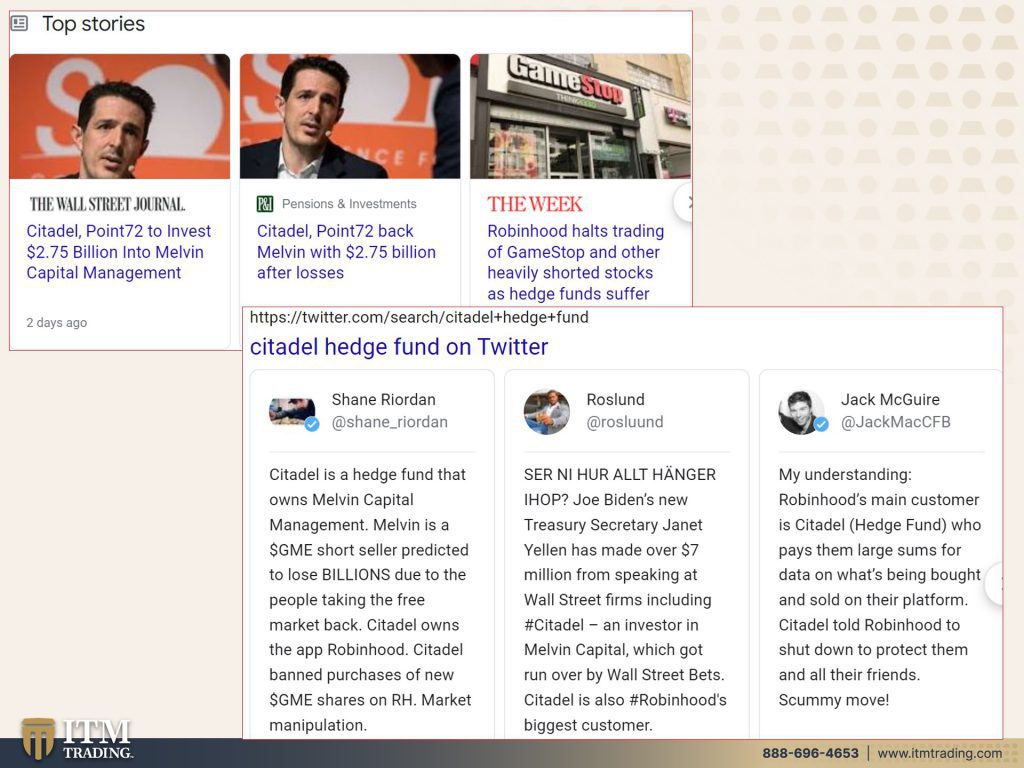

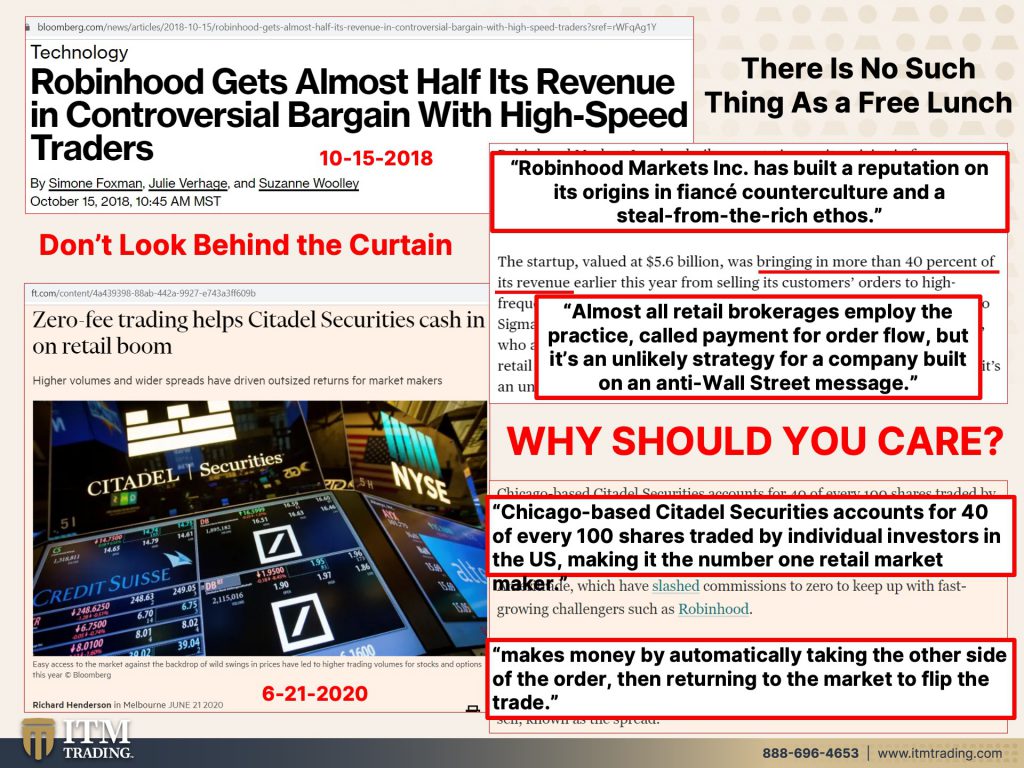

So why would Robinhood, supposedly founded out of the “Occupy Wall Street” movement and a steal-from-the-rich ethos, restrict their client’s ability to take down wall street when there is already so much blood in the street? And how have the hedge funds, particularly Citadel Securities, the largest “retail” market maker of securities, who had shorted GameStop, survived?

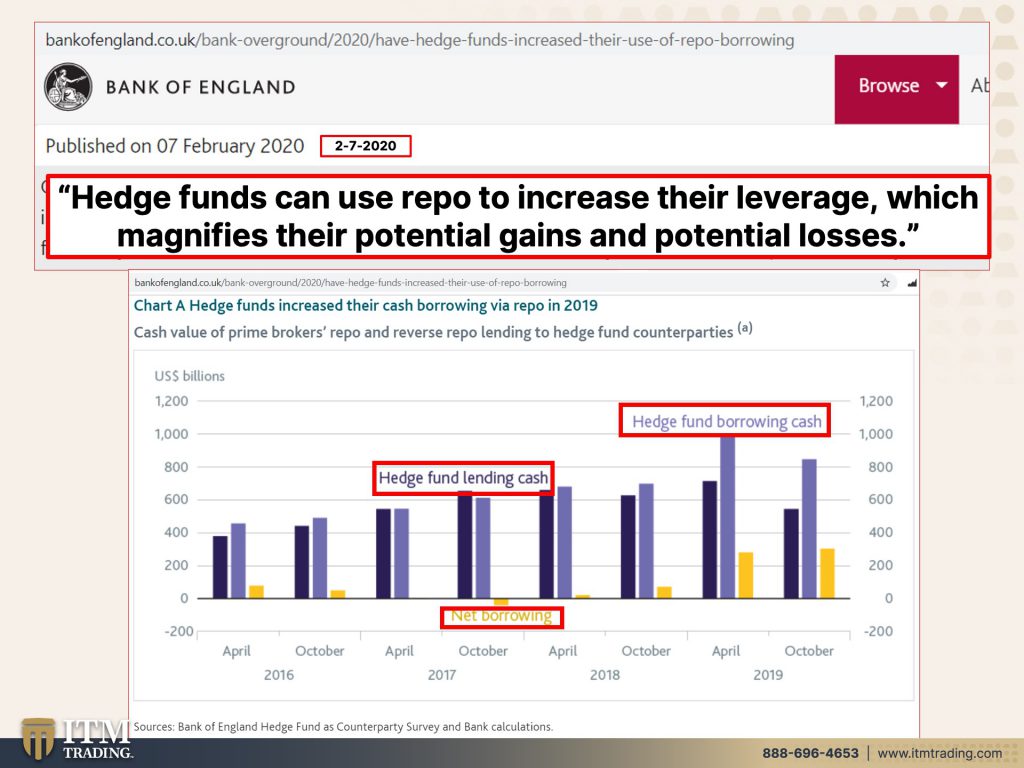

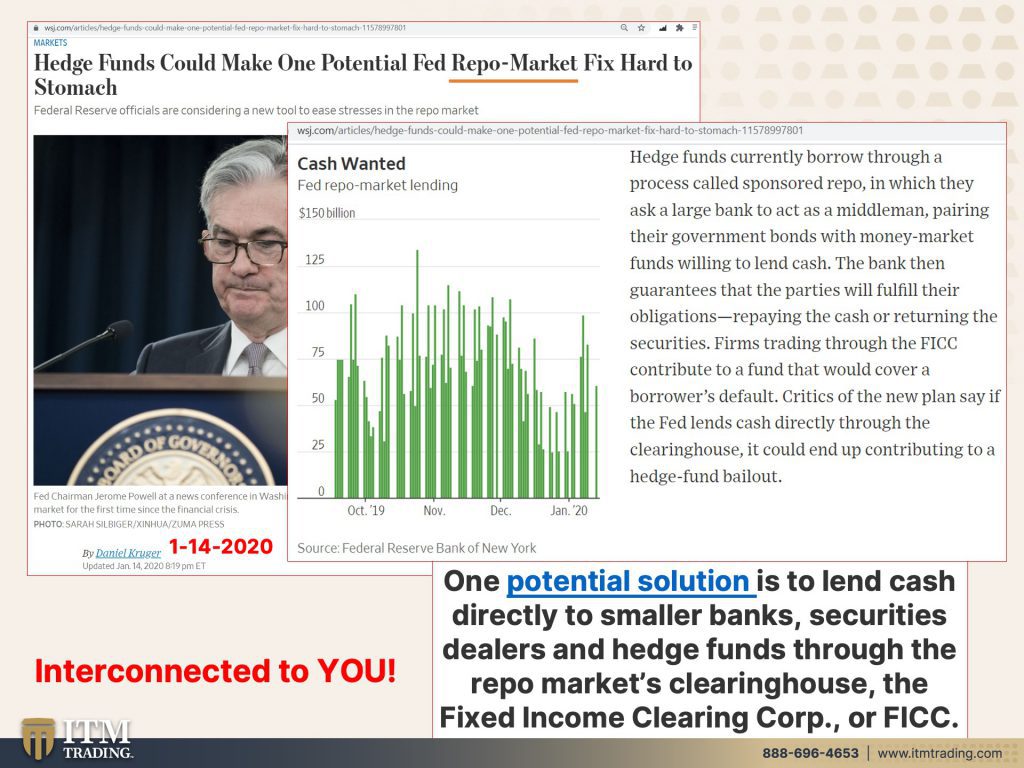

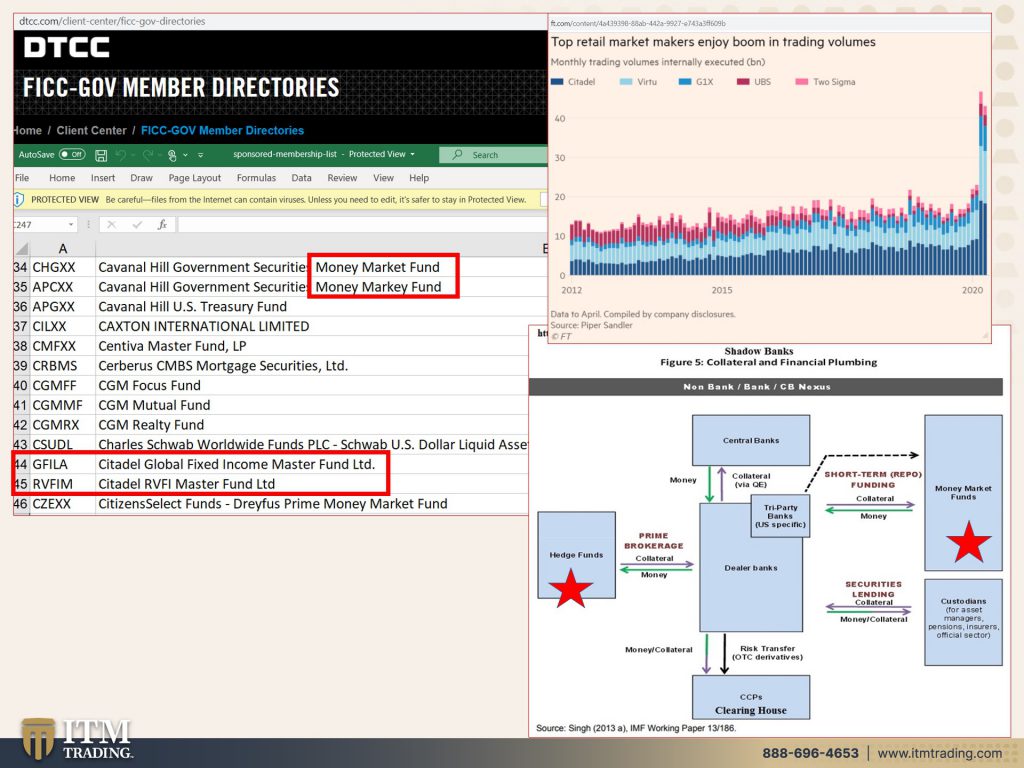

Well for that, you have to go back to September 2019 and the repo disaster that signaled the end of this fiat game. Remember the trillions the Fed pumped into the system so money market funds did not freeze and reveal the truth to the average investor? After that, in true central bank fashion, they changed the rules and kept the behavior, by giving hedge funds access to the Fed directly, as witnessed on the DTCC web site. As a reminder DTCC is the custodian and legal registered owner of ALL fiat money products held in brokerage accounts.

But it did not end there. Using the covid crisis to inject massive amounts of new money into the financial system, though this time, some of that new money made it into the public’s hands. Many used that to trade this one-way market. Then coupled with social media and what you have is an explosion.

Now a Reddit post is talking about executing a short squeeze on spot silver contracts. What would happen if a certain amount of these traders stood for delivery? Or will the rules be changed again and the central bank and wall streets manipulations be made visible this time? Who is really behind this movement?

But through all of this, can you see how easy and cheap it is to manipulate digital assets? Is this where you want to hold all your wealth? Or will you take this opportunity to position into real, hard money assets…physical gold and silver.

Slides

Sources

Slide 1:

https://www.cnbc.com/2021/01/28/reddit-co-founder-alexis-ohanian-calls-gamestop-frenzy-a-bottom-up-revolution.html

https://www.cnbc.com/2021/01/27/hedge-fund-targeted-by-reddit-board-melvin-capital-closed-out-of-gamestop-short-position-tuesday.html

Slide 2:

N/A

Slide 3:

https://www.bloomberg.com/news/articles/2018-10-15/robinhood-gets-almost-half-its-revenue-in-controversial-bargain-with-high-speed-traders?sref=rWFqAg1Yhttps://www.ft.com/content/4a439398-88ab-442a-9927-e743a3ff609b

Slide 4:

https://www.bankofengland.co.uk/bank-overground/2020/have-hedge-funds-increased-their-use-of-repo-borrowing

https://www.cnbc.com/2021/01/28/robinhood-interactive-brokers-restrict-trading-in-gamestop-s.html

Slide 5:

https://www.wsj.com/articles/hedge-funds-could-make-one-potential-fed-repo-market-fix-hard-to-stomach-11578997801

Slide 6:

https://www.ft.com/content/4a439398-88ab-442a-9927-e743a3ff609b

https://www.dtcc.com/client-center/ficc-gov-directories

Slide 7:

https://www.marketwatch.com/story/silver-rallies-after-reddit-post-about-executing-a-short-squeeze-11611855032

Slide 8:

N/A