2016 Gold Investing Results

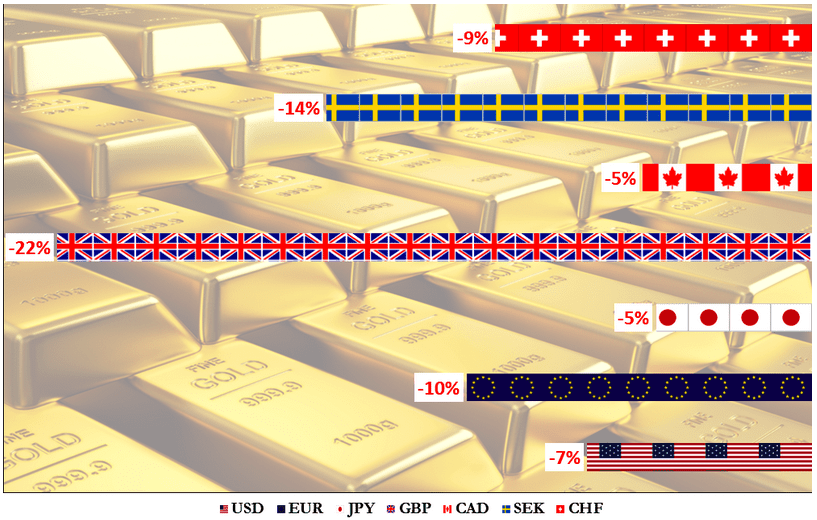

2016 is in the books. The year is over and those that tally numbers have tallied them. Some investments have done well, some not-so-well. Gold started off the 2016 year very strong against the US dollar. However, gold prices dropped quite a bit during the latter part of the year. Gold prices did, however, manage to post a 7.11% gain against the US dollar last year. The 2016 gold investing results, however, involve more than just the US.

Gold is an international currency which competes against all fiat and paper currencies. Investors from all around the world hold gold for a variety of reasons. Let’s take a look at some international 2016 gold investing results and some reasons people around the reason own gold.

< Buying Gold Bars Online Free Delivery >

Why invest in gold? Gold investing results : Brexit.

In a somewhat surprising turn of events, Britains voted to leave the European Union. This vote seemed to come out of nowhere and the results of the vote also seemed unexpected. As a result, the 2016 gold investing results against the British pound are quite remarkable. The precious yellow metal posted a 29.6% rise against the UK fiat currency. Belhassen Neili wrote an interesting article for TheMarketMogul.com in which he states these figures and reminds us that there was a similar British pound meltdown in 2008 when the euro rallied heavily against the pound. UK gold holders were protected.

Neili also offers an interesting UK financial scenario and example regarding holding gold. Neili states that a 100-pound gold purchase in 2000 would be worth roughly 512 pounds now. He also points out that gold does not have any third-party risk and can be used as a safe haven against any falling currency.

Why invest in gold? Gold investing results 2016 : The Euro.

Those in the UK that held euros and euro-denominated investments fared better than those in the British pound. However, the euro still lost 10% of it’s value against gold.

To view this in a different perspective, any euro investment really has to return at least 10% just to offset the loss in purchasing power that the euro experienced in the last 12 months. Likewise, in the case of the US dollar, dollar denominated investments realistically needed to return at least 7% to offset the decline in the purchasing power of the dollar.

Both the euro and the dollar have serious issues. Both are debt instruments financing more debt than ever. This bodes well for continued long-term gold price increases against these currencies.

2016 Gold Investing Results : Canada.

The Canadian currency, which is also called a dollar, slid five percent against gold in 2016. In 2015, the Canadian dollar, which also carries the nickname of “loonie”, lost 8% against gold. In fact, the loonie was the biggest loser of all major currencies in 2015. If you are a Canadian and you are not diversified into gold and out of loonies, you are not doing it right.

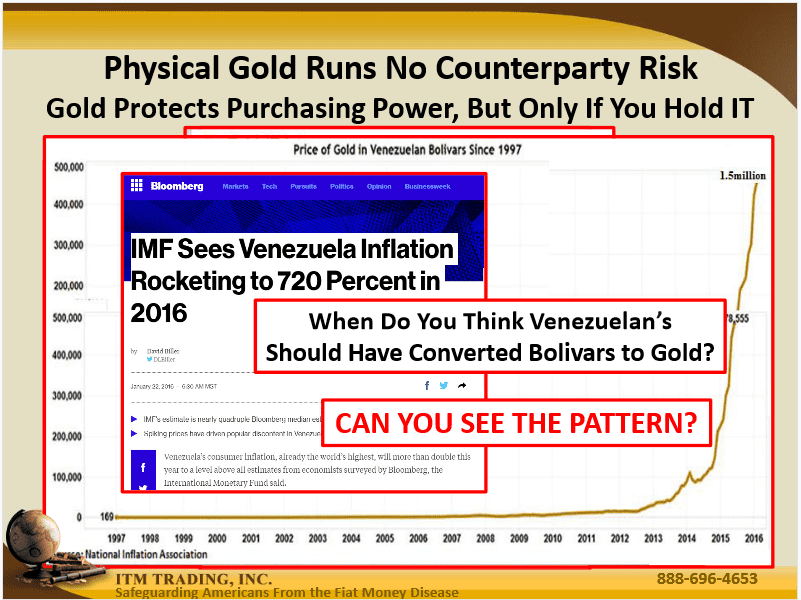

The drop in the value of the Canadian currency has been largely blamed on or at least related to the drop in oil prices. The drop in oil prices has also caused other oil dependent currencies, such as the Venezuelan Bolivar, to plummet. In fact, the Bolivar has all but completely collapsed. See the graph below.

If the country that prints the currency you carry depends at all on high oil prices to thrive economically, then you need to be diversifies into physical gold. Oil prices have crashed in the past few years and they don’t look like they are going back to $150 a barrel anytime soon.

2016 Gold Investing Results : Japan.

Japan’s currency, the yen, fell 5% against gold in 2016 as well. Japan has had decades of zero percent interest rate policies and has even experimented with negative interest rates. In addition, whatever economic policies the Japanese government is trying are having a whipsaw effect on the currency. Last year the Japanese yen gained 10% against the price of gold.

Though it seems ironic, governments, including the Japanese government, don’t want a strong currency. Ultimately, a strong currency makes it tougher for a country to export goods and pay down debts. Meanwhile, the people of that country want a strong currency so that they can save and have lasting wealth for later in life.

Ultimately, every government that uses fiat currencies (all of them) is directly at odds with the long-term savings needs of it’s citizens. Similarly, in the US, we experienced an even wider currency whipsaw as the dollar also rose 10% against gold in 2015 but fell further than the yen by 2% in 2016. Currency instability makes long-term financial planning and wealth-building much more difficult on many fronts.

Investing in gold vs Currencies : Sweden And Switzerland.

The Swedish and Swiss currencies also fell against gold this year. The Swiss franc finished down 9% against gold in 2016.

The Swedish krona gained 2% against gold in 2015, but these gains were not as strong as other currencies had managed. In 2016, however, the krona plummeted 14% in value against gold. Only the British pound fared worse in 2016.

Investing in physical gold : Own Gold. And Silver.

It should be mentioned that there was one particular currency that did perform better than gold this year: silver. Silver prices were up a bit more than 13% in 2016.

Realistically, the debt-laden fiat currencies around the globe are imploding. Owning gold and silver is the best way to protect your wealth. Request a free gold information kit today and begin acquiring precious metals.